A guide to understanding your Closing Disclosure

What You’ll Learn

How to understand your Closing Disclosure form

Why your Closing Disclosure may vary from your Loan Estimate

The significance of different dates on your Closing Disclosure

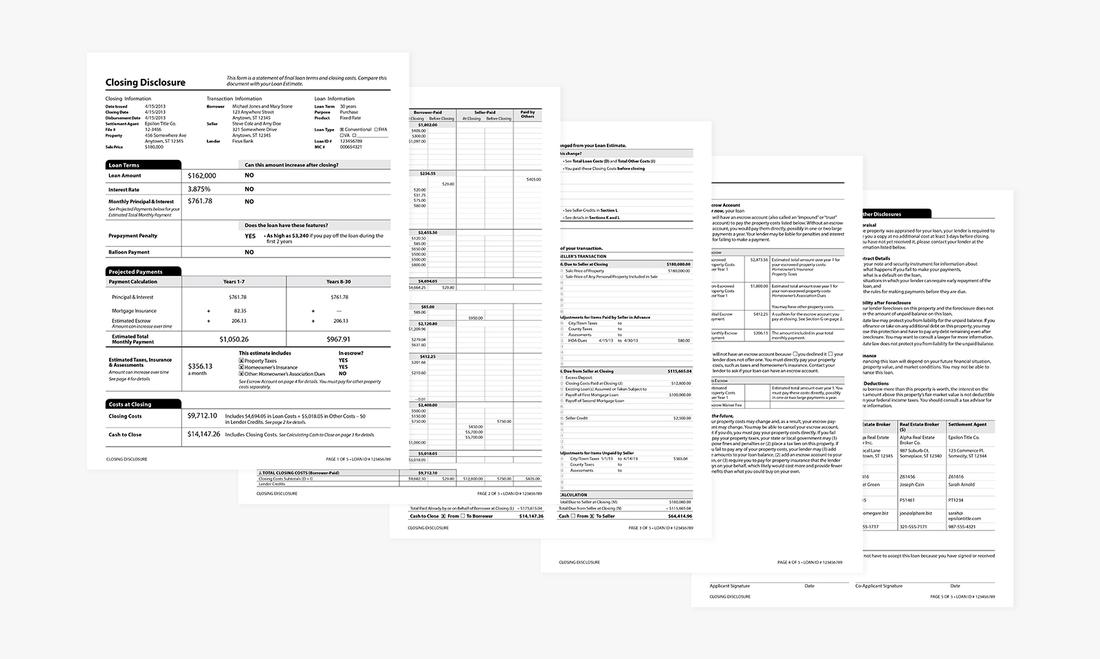

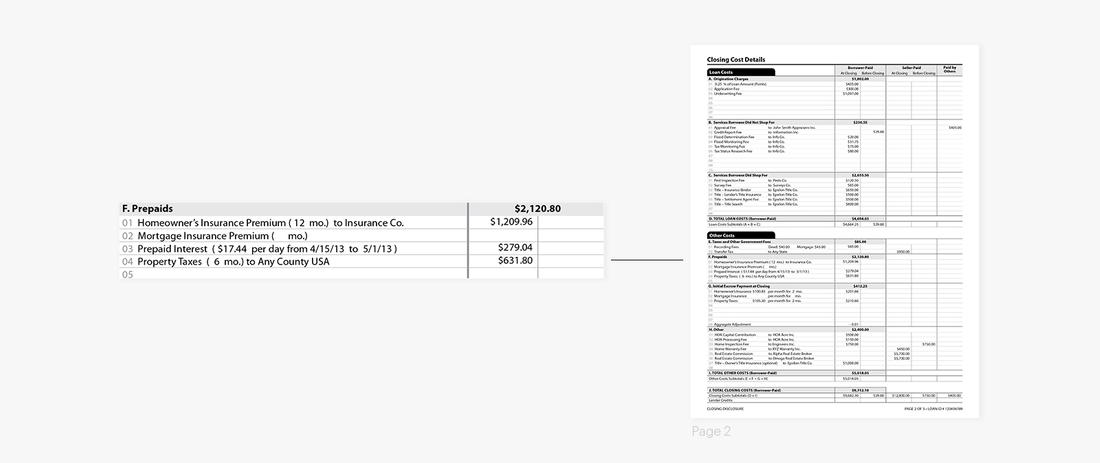

A Closing Disclosure is a five to six page form that provides final details about the mortgage loan you have selected, including the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

For illustrative purposes only.

Mortgage lenders are required to provide the initial Closing Disclosure at least three business days before you close on your loan, giving you time to compare your final terms and costs to those estimated in the Loan Estimate you had previously received.

That three days also gives you time to ask any questions before you go to the closing table.

You should receive your initial Closing Disclosure, any revised Closing Disclosures (if necessary), and your final Closing Disclosure, which you will sign on paper on the day of closing.

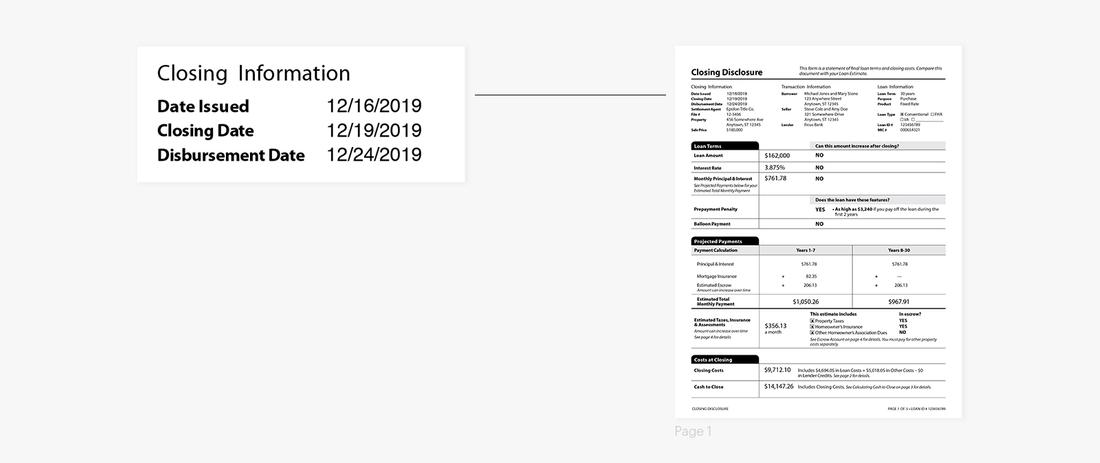

There are three important dates reflected in the top left corner of your initial Closing Disclosure:

Date issued: the date the initial Closing Disclosure was provided to you. For the purposes of the closing date, we assume you will acknowledge receipt of the initial Closing Disclosure the same day it was provided to you.

Closing date: if you’re refinancing an existing mortgage, we assume you will close three business days after you’ve acknowledged receipt of the initial Closing Disclosure.

If you’re purchasing a new home, the closing date will reflect your “Close of Escrow” date (if the state you’re purchasing in requires closing and disbursement to occur on the same day).

If you’re purchasing a new home in a state that allows you to close prior to your “Close of Escrow” date, then the closing date on your initial Closing Disclosure will reflect your earliest possible signing date.

Disbursement date: the date your loan will fund, which is generally the same day the title company will “disburse” your transaction (to be recorded with the county, payoff any existing liens, pay third parties, initiate any cash back you’re receiving, etc.). If you’re refinancing the existing mortgage on your primary residence, then the disbursement date will reflect the first business day after your three-day “right of rescission” has passed. The disbursement date is also the date prepaid interest starts accruing on your new mortgage (see section F of your Closing Disclosure).

Q&A with a Closing Expert

Thomas Lyons,

Closing Expert

Below are some questions you may have regarding your initial Closing Disclosure. If you’re currently working with us at Better Mortgage and you find any errors on your Closing Disclosure or want clarification around what you’re seeing, reach out to your Closing Expert for more information.

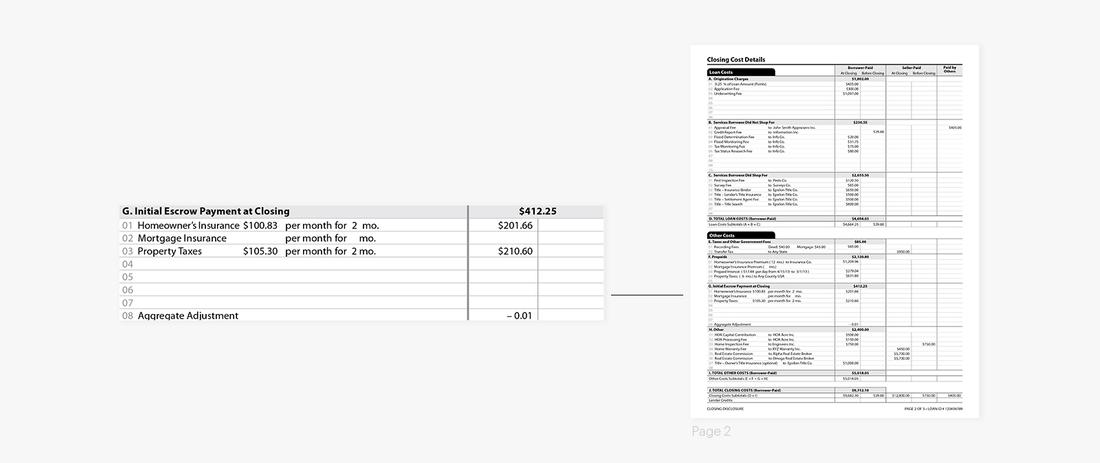

What are escrow accounts and aggregate adjustments?

The purpose of an escrow account is to build reserves (included in your monthly payments) to be used in future installments toward property taxes and homeowners insurance. You will see these deposits for future installments in Section G of your Closing Disclosure. If your closing is moved from one month into the next (closer to the due dates for future installments), you will see your escrow deposits increase by one month.

We include a two month buffer for both taxes and insurance, and by law we cannot collect more than a two month buffer — the purpose of the aggregate adjustment is to ensure we’re not collecting more than the two month buffer.

Why are you collecting property taxes and/or homeowners insurance as a prepaid?

If property taxes are due and payable (generally if they are due within 60 days of closing or due in the month of your first mortgage payment), they either need to be paid through your new mortgage as a prepaid charge, or paid outside of closing (with proof of payment provided). You will see prepaids in Section F of your Closing Disclosure.

If your homeowners insurance renewal is due, then we will need to ensure the renewal premium is going to be paid as well. If you have waived your escrow account and are on a month-to-month plan for paying your homeowners insurance, we will likely collect at least three months of homeowners insurance payments on your Closing Disclosure to ensure your policy is paid through the your first mortgage payment.

If either the policy renewal for your homeowners insurance or upcoming tax installment is being paid by funds from your existing escrow account, we can generally use that as sufficient proof to remove the prepaid charges from your Closing Disclosure.

How is my payoff calculated? (refinance transactions only)

The payoff to your current lender includes your outstanding principal balance (this is typically the figure you'll see on your current lender's website, which doesn't include other fees), interest due, miscellaneous fees, and an interest buffer of at least seven days to ensure the payoff isn't short. Sometimes there’s a gap in processing between the time the payoff is sent to your current lender and when they actually process and apply those funds to your outstanding balance.

My spouse is not on the loan and I don’t want them liable for this loan. Why are they listed as a borrower?

Any person on the title (depending on state and local laws) is required to sign the Closing Disclosure. Although this person may be listed as “borrower” on the Closing Disclosure, this does not mean they are financially responsible for the loan. The only people financially responsible are those listed on the promissory note itself.

If your spouse is not on title, they may still be required to sign some documents depending on the laws in your state.

If you have any questions or concerns, please ask your Closing Expert for more information.

*/}